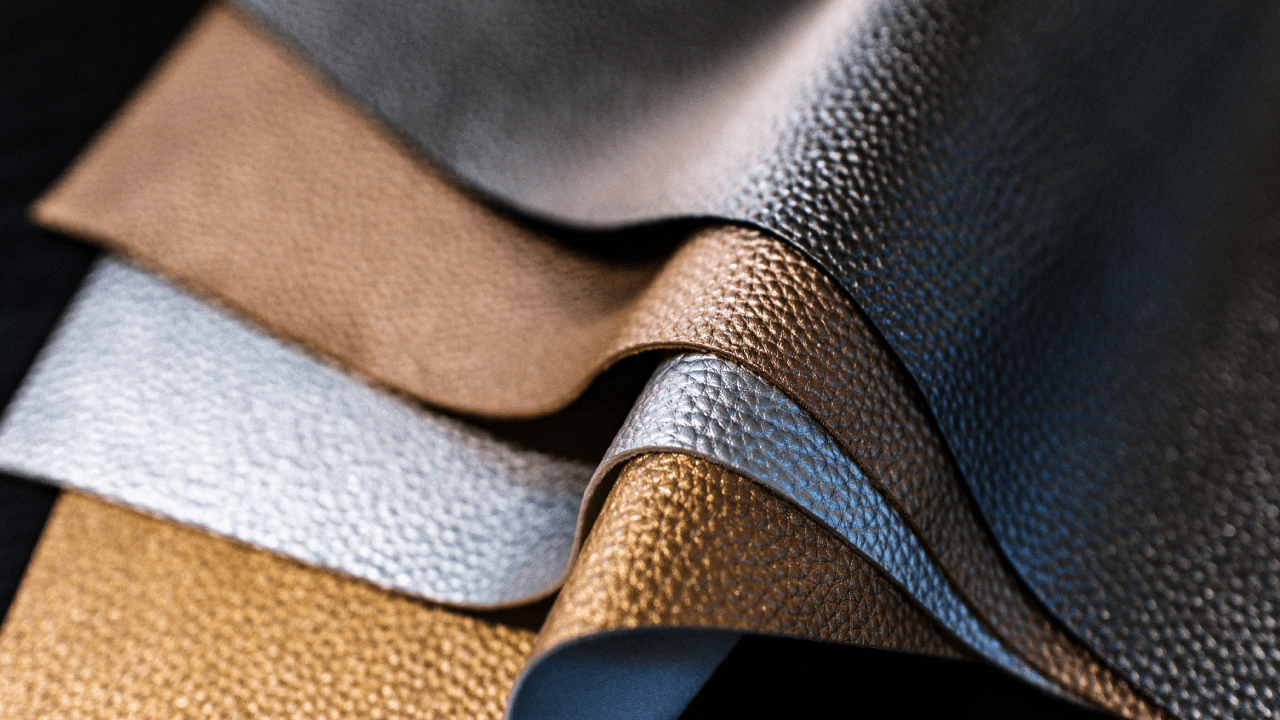

The making of leather goods is a competitive business, with little room for error. You may be a producer of leather apparel, including clothing and outerwear, or you may be focused on smaller goods made from leather, including wallets, handbags, upholstery, sporting goods or suitcases. Regardless of whether you are a small or large leather goods manufacturer, or what type of products you produce, you need to protect your business from the risks inherent in working in this industry.

As you engage in the process of converting animal hides into consumer products, there are many hazards that can arise. You may be in the business of producing leather from hide to finished product or you may complete part of the manufacturing process at your facility. You still require protection in a few different areas.

What type of insurance should a Leather Goods Manufacturer hold?

- Commercial General Liability Insurance is necessary for Leather Goods Manufacturers. If your business is sued for property damage or bodily injury related, this is the coverage that would protect you and help cover legal and damage costs. Your CGL policy covers your location and all aspects of your business, including your machinery, products, raw material and stock. You may wish to add Product Liability insurance to your CGL policy, to protect you from any fallout resulting from your customers or others suffering bodily injury or property damage as a result of your products. Your ALIGNED broker will determine your needs based on the unique characteristics of your business.

- Commercial Property Insurance protects you in the event that your business locations, including any retail or manufacturing facilities, are damaged by a perilous event such as lighting, a fire, vandalism or mischief. This type of coverage would include your business assets as well, such as equipment and goods.

- Pollution Liability is another coverage to consider for those Leather Goods Manufacturers that are working with raw materials and doing larger scale manufacturing. This coverage would protect manufacturers in the events of a chemical spill or other contamination that results in bodily injury or property damage.

- Umbrella Liability Insurance and Cyber Liability Insurance are two additional coverages to consider and to discuss with your ALIGNED broker. Umbrella coverage kicks in when your CGL policies are exhausted in the case of a major event. Cyber Liability coverage is important to protect your online assets and data, including your website and any customer or product information. If you are hacked or data is somehow lost, you can be covered for these serious losses.

When do Leather Goods Manufacturers need insurance?

While the possibilities may seem remote, any of the following occurrences could drastically affect your business:

- Your staff person is delivering finished goods to a customer when they spill coffee all over one bag of the shipment. It needs to be replaced.

- A batch of leather pants causes skin problems for some of your customers. They seek redress from you.

- Some of the contaminated water from leather dyeing is released into the local water system when improperly disposed of by your employee. Your municipality sues your company for damages and cleanup costs.

Find the Right Leather Goods Manufacturer Insurance from ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.