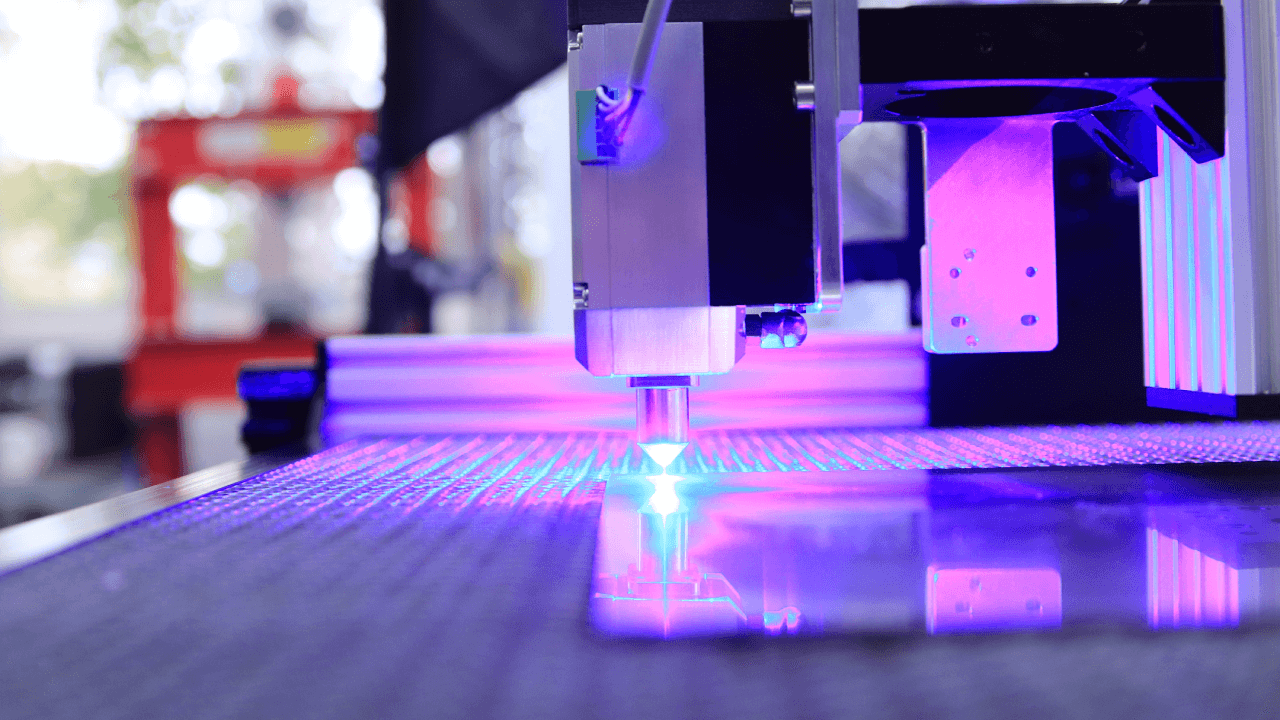

As the owner of a Laser Cutting Service, you are on the vanguard of technology. This technique of working with various materials involves such precision that you are cutting – or vaporizing – down to as narrow as 10mm. Laser cutting is usually used in industrial manufacturing, but increasingly it has become more mainstream and is being used in other applications.

You are able to deliver a precise and innovative finished product to your customers in a variety of mediums. Your skills are in high demand, but your work is not without its risks. Learn how you can protect your business and investment with the right insurance coverage.

What is Covered with Laser Cutting Service Insurance?

In this fast-paced field, you need to be sure your business is well protected against potential claims related to your operations. Whether you work specifically with Laser Cutting or also bend or fabricate other metals, you are exposing your business to a variety of risks.

Your equipment and stock are also very valuable and must be covered under a business insurance policy.

A customized Laser Cutting Service Liability policy for your business should include coverage related to your products, location, and business practices to protect against claims of property damage or bodily injury.

Firstly, a Commercial General Liability (CGL) policy is the most common type of policy for business owners and can include coverage for property damage, medical bills, lawyer fees, and settlement costs. Operating without a CGL that is customized to your Laser Cutting Service business is inadvisable for any small business because a claim against you could cause significant financial impact and potentially shutter your operations.

Secondly, there are a number of additional coverages you should consider for your Laser Cutting Service, such as:

Small Business Property – protect your location and contents from extended perils like floods, lightning, fires, vandalism, theft, and mischief with this coverage.

Business Interruption – you still have to pay bills if your business cannot operate for some reason. This coverage allows you to keep things running in the event of a significant interruption.

Equipment Breakdown Insurance – your laser cutting equipment is at the heart of your business and it’s difficult to run your business without it. Protect yourself against breakdown events with this coverage.

Commercial Vehicle Insurance – if you or your staff operate company vehicles for your business, including deliveries, this is an essential coverage. You can tailor your commercial vehicle insurance to cover your staff doing your business, such as deliveries, in their own vehicles as well.

What are some possible incidents that could negatively impact your business?

- Your staff person accidentally cuts a client’s provided material to incorrect dimensions, making it too small. The piece has to be replaced and recut.

- Your new laser cutter arrives damaged and you cannot operate while it is replaced.

- While delivering a finished product to a client, your employee’s company vehicle is struck and the piece is damaged, along with your work truck.

- Your website is hacked.

As the owner of a Laser Cutting Business, you have to be prepared for the risks that could affect your business and plan for them as best as possible. With the help of an ALIGNED insurance broker, you can identify where your business’ risks lie and customize the appropriate insurance coverage to protect your operations.

Find the Right Laser Cutting Service Insurance from ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.