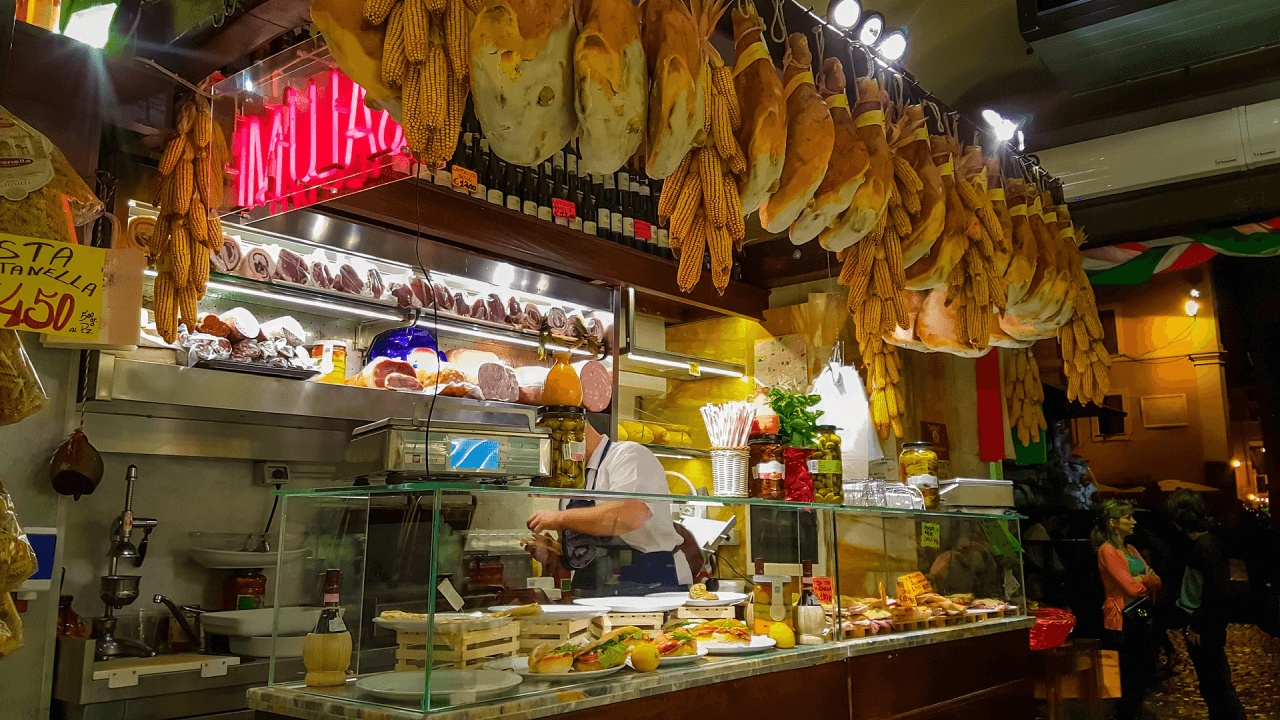

Deli Shop Insurance

In a world where people can have different ideas about lunch while preferring different dishes, deli sandwiches are the one food that everyone can generally agree on.

However, when you’re planning for the next lunch rush and dealing with loud and hungry customers, it’s important to remember that there are risks involved with running your own shop. A solid deli shop insurance policy can help make it easier for you to protect your business and everything you’ve worked hard to build over the years.

Here Are 3 Coverage Options for Deli Shop Owners to Consider

1. Commercial General Liability Insurance

On any given day, your shop likely sees a steady stream of customers. And any time that you’ve got regular foot traffic, there’s always a chance that someone might get hurt.

Commercial general liability insurance is a useful coverage option for deli shops because of how it covers situations where a third party, like a customer, has sustained property damage or bodily injury while on your property. This flexibility is a big part of what makes it a solid choice for deli shop owners who operate out of physical store locations.

Another key coverage for every deli shop owner is product liability insurance is part of the typical commercial general liability policy and provides coverage if a customers alleges they became sick or injured after using or consuming one of the products you sell.

2. Commercial Property Insurance

If a fire were to destroy your cash register or a bad hail storm were to damage your windows and many of your supplies along with it, would your business have the cash to replace everything on short notice? Another reality of owning a physical, brick-and-mortar building is that you more than likely rely on certain pieces of equipment to make your sandwiches.

Commercial property insurance is useful because it can help you cover the costs associated with replacing and repairing items that have been damaged by an insured peril.

3. Business Interruption Insurance

If you’re like many business owners, your shop likely represents a substantial portion of your income. But one of the biggest problems with covered losses is that it may not be possible to go back to business as usual until repairs and replacements are made.

Business interruption insurance can compensate you for the bills, lost income, and payroll expenses that would have likely occurred while your company was out of commission. This in turn makes it possible for you to keep your business afloat without having to dip too far into your company savings to do so.

Related Articles

- Food Processing Insurance

- Food Retail Insurance 101

- Food Truck Insurance Overview

- Food and Beverage Insurance

- What You Should Know About Food and Beverage Insurance

- Insurance For Frozen Food Stores In Canada

Get Top-Notch Deli Shop Insurance With the Help of Your ALIGNED Broker

Having the right insurance coverage for your deli shop makes it possible for you to protect your business and your livelihood in the face of an insured peril. Contact ALIGNED to get started on your insurance journey.