Basic Food and Beverage Insurance Coverages

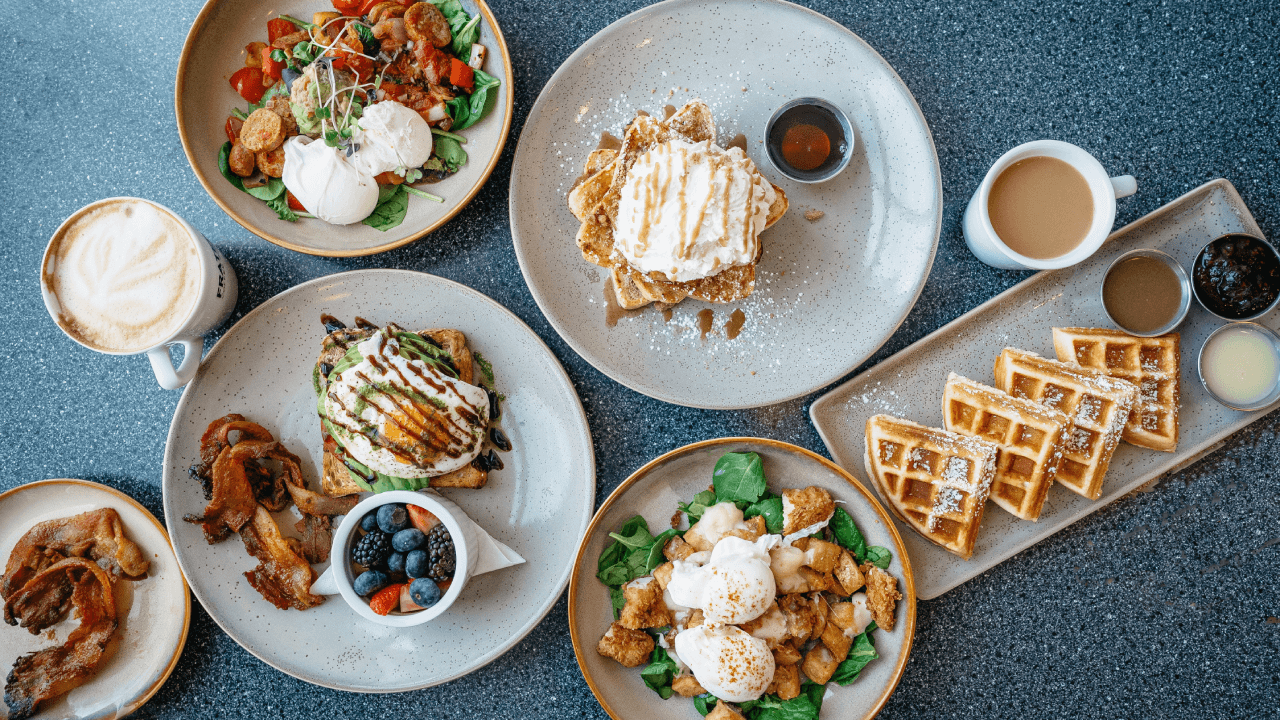

We all gotta eat. Whether you produce or serve food and beverage products, your choice to work in the food and beverage industry can be as lucrative as it is risky.

Our food and beverage insurance packages are customized for your specific bar, restaurant or food processing plant, no matter how big or small, to protect you from the risks that come with food and beverage service.

Commercial General Liability Insurance – CGL is a common policy for every business. It can cover medical expenses and property damage costs to third parties along with legal fees, settlements and judgements for lawsuits alleging personal injury, property damage, false advertising, libel and slander.

For the food and beverage industry, this is crucial. For eateries, cafes, bars and even food processing plants, this means liability coverage and protection from the dreaded “slip and fall” injury.

For food and beverage processors and food and beverage retailers, adding Product Liability Coverage to your CGL coverage can also provide coverage for:

- Medical expenses for injuries to consumers, lost wages and other liability costs

- Lawyer’s fees and defence costs

- Out-of-court settlements

- Judgements/awards for damages

if consumers are harmed by your products. Even if your company is not involved in the processing or manufacturing of food or beverage products, you may not be fully protected in a lawsuit if you sell a contaminated product. The manufacturer could be overseas, their insurance policy may not cover you or only partially cover your liability exposure.

It’s also important to remember that even if you’re ultimately cleared of liability, being named in a lawsuit alone can cause damage to your reputation while causing a flood of expenses, stress and hassles.

Product Recall Insurance – This is essential coverage for food and beverage producers, manufacturers and processors.

As part of a food and beverage insurance package, product recall coverage can be included at nominal limits or can be purchased on a standalone basis. Either way product recall insurance can cover the costs to recall your products and the expenses that come with a recall including replacement costs, public safety announcements, product testing, lost profits, brand rehabilitation expenses and the extra salary expenditure needed.

Finally, for licensed food and beverage establishments, including liquor liability coverage in your CGL policy is crucial to protect you from liability for the actions of intoxicated guests. For example, if a patron becomes intoxicated at your place of business and causes injuries to a third party or property damage, you’re protected from potential liability.

Other Insurance Coverages for Food and Beverage Businesses

Depending on the type of food and beverage business you’re in and the size of your operations, you may also need some level of protection from the following coverages:

Property Insurance as well as Extra Expense and coverage

Crime Insurance / Fidelity Insurance

Boiler & Machinery Insurance / Equipment Breakdown Insurance

Cyber Liability & Privacy Insurance

Get ALIGNED with Food and Beverage Insurance Brokered by Commercial Insurance Specialists

Insuring businesses is all we do. Our commercial insurance specialists work with Canada’s top insurance companies to get your food and beverage company the best rates for comprehensive food and beverage insurance coverage.

Contact an ALIGNED advocate or get a quote online in minutes.