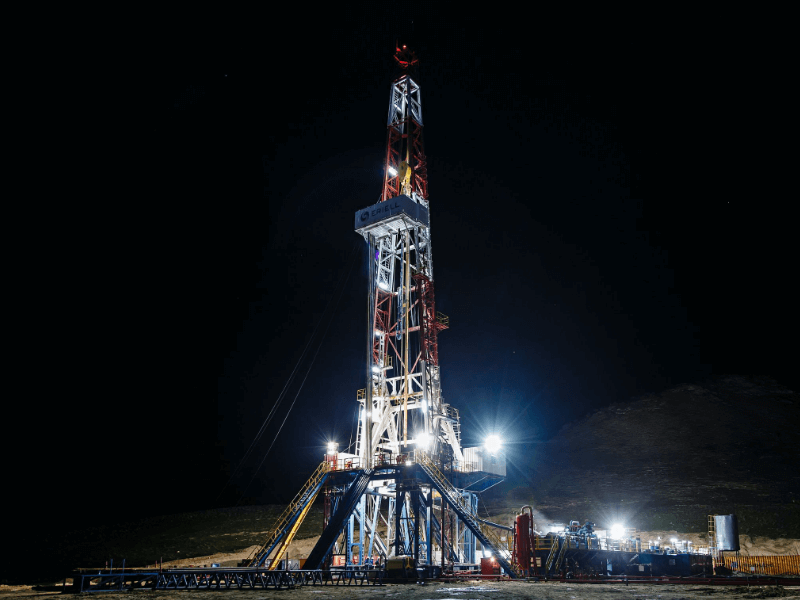

Oil and Gas Company Insurance

Canada’s oil and gas industry is the world’s fifth-largest producer of oil and natural gas. We understand that the industry is complex yet crucial to the global economy and the lives of millions of people. Whether you are an independent contractor, oilfield consultant, supervisor, or operator, we provide custom oil and gas company insurance to protect your business from the risks and potential litigations that can arise.

Why is Oil and Gas Company Insurance Important?

The oil and gas industry relies on many complex processes and specialized equipment to get the job done. Insurance will provide coverage against risks that occur despite your best preventative measures:

- Hazardous materials may cause fires or risks when inhaled for long periods.

- Third parties may suffer injuries on-site from equipment, falling objects, machinery, etc.

- Poor weather conditions may cause damage to the site or equipment.

- On-site spills may cause contamination or pollution.

Having oil and gas company insurance protects your business and gives you peace of mind.

What Does Oil and Gas Company Insurance Cover?

Our oil and gas company insurance coverages are customizable to your specific business needs, risk management concerns, operations, and budget.

Whether you are transporting oil and gas from Alberta to a different province, within the province, or abroad, here is what common commercial oil and gas company insurance coverages include:

Commercial General Liability Insurance – Also known as CGL insurance, commercial general liability insurance is the most common type of coverage provided to oil and gas companies and contractors.

Pollution Liability Insurance – Covers cleanup and litigation costs associated with spills and site contaminations of hazardous materials. For example, if there is an oil spill while transporting goods, pollution liability insurance will help you with cleanup and disposal expenses. Pollution coverage can be purchased by producers and/or by contractors.

Professional Liability Insurance – Also known as Errors and Omissions insurance, it covers financial loss arising from errors, omissions, and negligence when performing professional duties for a fee. It’s commonly purchased by oil and gas consultants and evidence of this coverage via a certificate of insurance is often required.

Commercial Auto Insurance – This is mandatory for all commercial vehicles in Canada. In a collision or car accident, commercial auto insurance provides coverage for third-party liability, physical damage and medical, property damage, loss of income, disability benefits, etc.

Commercial Property Insurance – Protects your property from damages and losses resulting from fires, lightning, earthquakes, floods, windstorms, etc. It covers the replacement cost and actual value of your property, and the types of perils covered depend on the coverage you choose.

Find the Right Oil and Gas Company Insurance from ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.