What is Side A DIC Directors Insurance Coverage?

Being on a board of directors is a great honour and privilege, but it also comes with risk. Regardless of whether it’s publicly traded company, privately held corporation or a not for profit organization being part of any organizations board of directors exposes your personal assets because if there aren’t any assets left in the organization individual directors and/or officers can be held personally liable for things like unpaid wages, unpaid taxes etc. As a result evaluating the financial stability of any organization along with the quality and scope of coverage provided by the board of directors insurance is important. However, evaluating how much directors insurance is enough and whether the directors and officers insurance is broad enough can be challenging given a constantly changing claims landscape and increasingly higher and higher settlements and judgments against directors and officers of Canadian organizations. This is why many board members, directors and officers are asking “What is side A DIC Directors Insurance Coverage?” and requesting Side A Difference in Conditions (DIC) Directors Insurance Coverage quotes from the insurance brokers at ALIGNED Insurance.

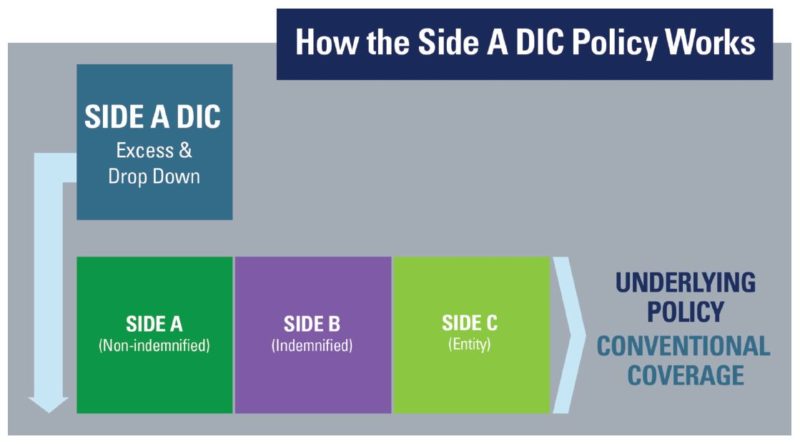

How Does Side A DIC Directors Insurance Coverage Work?

Side A DIC directors insurance coverage is excess insurance that is solely available to the individuals covered by the underlying directors & officers insurance policy and it functions in the following ways:

- Side A Difference In Conditions insurance coverage provides excess coverage when the underlying D&O Insurance policy is used up.

- Side A Difference In Conditions insurance coverage responds when a claims is excluded the underlying policy.

- Side A Difference In Conditions insurance coverage is triggered when an organization withholds indemnification.

Graphic courtesy of Encon Group Inc.

| ALIGNED Across Canada

100% Canadian owned, ALIGNED is a premiere insurance brokerage that serves more than 1,400 clients across the country. ALIGNED’s offices in Toronto, Calgary and Vancouver are supported by a national operations centre in Cambridge, Ontario. Uniquely within the industry, ALIGNED creates, negotiates and delivers the best business insurance and risk management strategies/solutions to organizations like yours. |