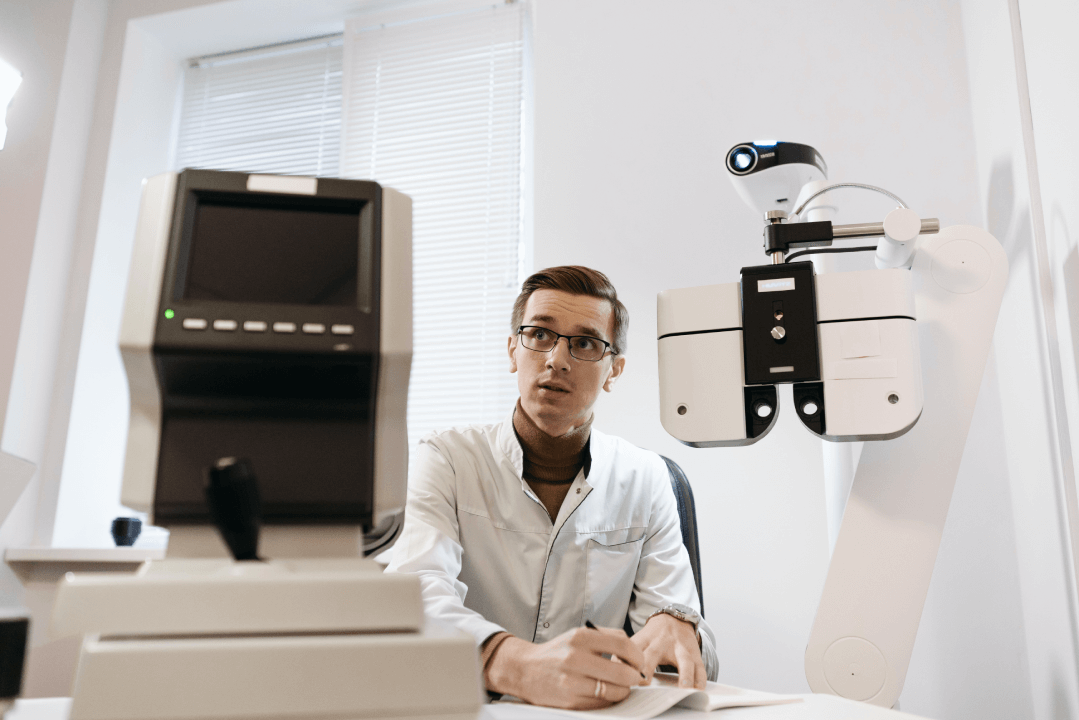

Opticians are highly trained professionals that play an important role in the lives of Canadians, helping individuals and families see the world. Opticians specialize in fitting clients with prescription glasses or contact lenses, assisting them in finding the right frames and lenses that suit their prescription and face shape. There’s a lot of stress, expertise, and specialized equipment involved in the role. As a result, there are a lot of risks.

One mistake can have big implications on the lives of their clients and their clinic. Whether you own an optician clinic or work at someone else’s clinic, purchasing insurance with the right optician insurance can protect your business and mitigate the risks and losses you might encounter.

Why is Optician Insurance Important?

Any time you provide assistance, advice, and examinations to clients, there are risks associated with the services you provide. Your customers can have different reactions to the glasses or contact lenses you prescribe, and despite careful precautions, unexpected events can still happen at any time. Here are some of the risks that your clinic might encounter:

- Your equipment breaks or malfunctions because of a leaking roof, water damage, or another accident.

- Your client is injured because of your services or while on your premises.

- Your client becomes ill or suffers an eye infection from contaminated equipment you use in your clinic.

- Your client suffers a physical injury because of the eye examination instruments or otherwise.

Opticians are required to carry insurance. With a team of ALIGNED experts, you can find optician insurance that fits your business perfectly.

What Does Optician Insurance Cover?

Optician insurance coverage is dependent on how much protection you need, the services you provide, and the experience and history of your clinic.

Here is what optician insurance policies can include:

Commercial General Liability Insurance – Also known as CGL insurance, commercial general liability insurance covers client bodily injury and property damage from the services and advice you provide and the equipment you use to operate.

Professional Liability Insurance – If your mistakes cause clients to not receive the results you promised, there could be lawsuits. For example, if you send your client home with the wrong glasses and they get into a car accident because they couldn’t see well, your client can sue your clinic. Professional liability insurance covers situations where your mistakes cause your clients to suffer losses.

Commercial Property Insurance – There are risks of damage to your commercial property and equipment. If a fire or theft results in losses and damages to your assets, commercial property insurance can provide compensation for repairs and replacements.

Find the Right Optician Insurance from ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.