Kinesiologist Insurance

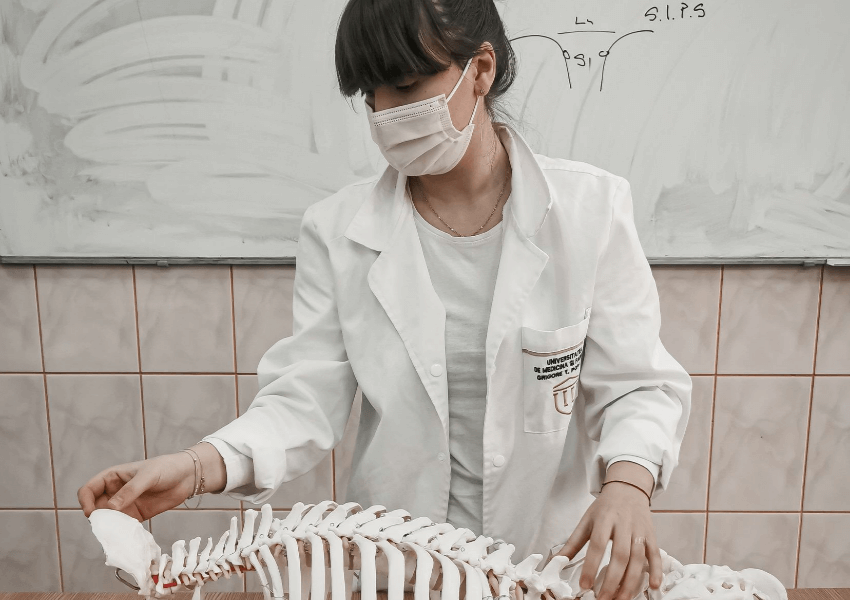

Whether you’re helping athletes rehabilitate after injuries or you’re helping workers protect themselves from workplace injuries, as a kinesiologist your knowledge of the human body is always in demand.

However, you know better than anyone how the human body can sometimes be unpredictable and fragile. And with your clients coming to you for education and solutions, there’s always an element of professional risk involved with giving advice that affects their physical wellbeing.

A solid kinesiologist insurance policy makes it possible to protect your livelihood and your finances.

The 3 Types of Insurance That Kinesiologists May Wish to Consider

1. Professional Liability Insurance

At the end of the day, your clients are coming to you because they’re looking for advice.

But even when you’ve followed standard practices to the letter, sometimes the body can be unpredictable. A patient could follow your advice on stretching only to pull a muscle and hurt themselves or simply be attending sessions with unrealistic expectations.

Even if you’re vindicated in court, you’ll still have to spend a lot of money on legal fees to get there. Professional liability insurance can help you with costs if you’re accused of negligence.

2. Commercial General Liability Insurance

If you operate out of a clinic, this insurance option is especially valuable for kinesiologists to have.

After all, you never know when a patient will trip over a bag in your session room or twist an ankle during a session. And if your client is carrying a valuable item like a laptop or a phone or an expensive pair of glasses when the accident happens, the damages they’re able to claim can go up accordingly.

For businesses that operate out of a physical location, commercial general liability coverage is popular in part because it can cover both lawsuit and judgement costs if a third party suffers bodily injury or has their property damaged while they’re in your building.

3. Commercial Property Insurance

From office furniture to exercise equipment, you more than likely can think of at least a few items that you rely on to do your job on a day-to-day basis.

Although it isn’t fun to think about, replacing equipment in the aftermath of a fire or an accident can be expensive. Commercial property insurance makes it possible for you to receive compensation for damaged professional equipment.

Here’s Why You Should Consider Working With a Broker for Your Kinesiologist Insurance Needs

As a kinesiologist, your interest in the human body isn’t just for show. It’s how you earn a living. When you work with an ALIGNED broker, you can be confident that you’re getting the coverage that you need at the best rates we can offer.

Contact us for your FREE kinesiologist insurance quote today.