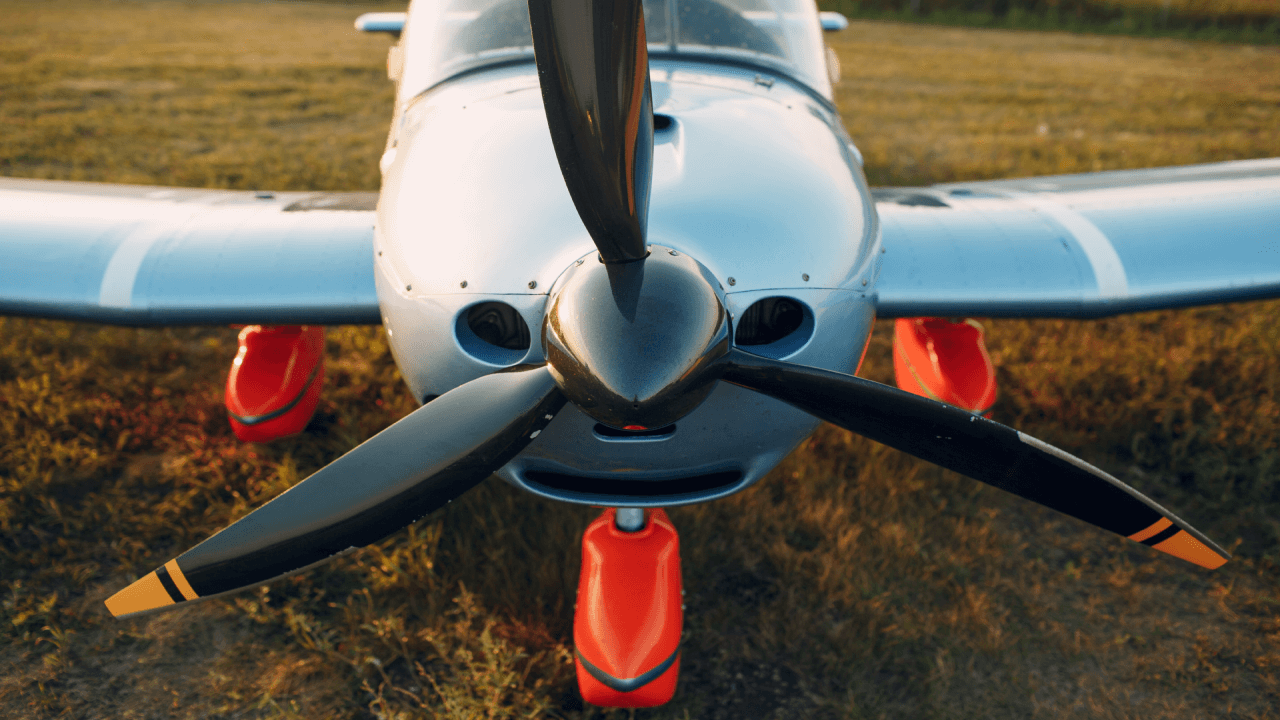

As an Air Taxi Charter business, you are in the business of providing aircraft charters to both business and personal clients. Your private charter services allow all of your customers to maximize time and efficiency by cutting down on travel time and offering a secure and enjoyable travel option.

For businesses, an Air Taxi Charter allows entire teams to travel together to a business destination. For leisure travel, private air charters ensure groups can travel together to events, celebrations and vacations in style.

Your Air Taxi Charter business may also be involved in transporting cargo or act as an air ambulance. You may utilize airplanes and helicopters in your business. Whatever the nature of your Air Taxi business, the right insurance coverage is essential to your business’ success and profitability over time.

In this complex industry, it can be difficult to know what the best coverage entails. That’s why we recommend you connect with an ALIGNED agent to discuss the best coverage options for your Air Taxi Charter business.

What Type of Insurance Does Your Air Taxi Charter Business Require?

Each and every registered aircraft that operates in Canada has to have certain insurance coverage, including protection against public liability and the risk of injury and death to passengers. The Canadian Aviation Regulations set out the amount of insurance required for air charters based on the number of passengers an aircraft can accommodate and the weight of the aircraft upon take-off. This required insurance does not cover damage to your airplane, however, and also does not cover injury or damage to third parties by your charter aircraft.

Generally speaking, additional aviation insurance will cover the plane itself, damage to third parties outside of the plane, and in many cases passengers. Some other examples of what additional aircraft insurance can cover are the following:

- Cargo and personal effects insurance for passengers

- Personal liability insurance for medical costs for treatments in the event passengers are injured while aboard your aircraft

- Temporary substitute aircraft in case one is necessary

- Airport premises liability

- Hangar/contents liability

Like general liability insurance, aircraft or aviation insurance can be designed to cover risks specific to your business.

What other types of insurance should you consider for your aviation charter business?

You should also consider Commercial General Liability Insurance to cover you in the event of bodily injury or property damage as a result of your operations or premises. For instance, if a piece of equipment falls off one of your aircraft and hits a building on the ground, your insurance can cover it.

Property Insurance guards against unexpected damage to your property, including instances of extreme weather or damage due to vandalism. If a hailstorm causes damage to your parked aircraft, this coverage can help.

Cyber insurance is also a consideration when dealing with passenger information, to protect against digital information seizures or losses.

While there may be numerous coverage options available, your ALIGNED agent will help zero in on the right ones for your business based on the number and size of your aircraft, how you use it, and where you fly, as well as other aspects of your business. Trust ALIGNED to guard against the risks you face as an Air Taxi Charter business owner.

Find the Right Air Taxi Company Insurance from ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.