General Aggregate Limit Explained

General Aggregate Limit Overview: What Is a General Aggregate Limit? A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Under some commercial general liability (CGL) policies, the general aggregate limit applies to all covered bodily injury (BI) and […]

Business Insurance Brokers Share Keys To Excel

Business Insurance Brokers Share Keys To Excel Insurance Business TV recently asked some of the nation’s Top 30 Business Insurance Brokers, including Andrew Clark of ALIGNED Insurance, what it takes to excel in the Canadian insurance market. Click Here to hear what Andrew Clark and his colleague had to say. To learn more about selecting the best business insurance […]

Failure to Insure Exclusion Analysis | ALIGNED Insurance

Failure to Insure Exclusion def: The failure to insure exclusion is found primarily in directors and officers (D&O) liability policies and, to a lesser extent, in public officials liability policies. The failure to insure exclusion precludes coverage for claims made against insureds when claimants suffer losses resulting from failure to purchase insurance coverage, provided such […]

Earthquake Coverage Explained

Earthquake Coverage Explained Earthquake Coverage def: Typically excluded (along with another earth movement) from most basic property insurance policies, except ensuing fire. In many cases, earthquake coverage must be purchased by endorsement , but is typically included in an “all risks” policy. Normally, the coverage provided is subject to a per-occurrence sublimit, an annual aggregate limit, and […]

Business Crime Insurance Coverage

What does a crime insurance policy cover? Q: What is Employee Dishonesty / Fidelity / Crime Insurance? A: Employee Dishonesty / Fidelity / Crime Insurance reimburses organizations from loss of money, securities, or inventory resulting from a crime. Every company, regardless of size, is a potential target for crime. Experts acknowledge that this is one of the […]

Defamation in Insurance Explained

What is Defamation Insurance? Defamation includes the spreading of damaging information or false statements about an individual or business that creates reputational harm. Defamation insurance, otherwise known as libel and slander insurance coverage, can cover legal fees, potential damages, and settlement payments that may arise from defamation lawsuits. Media liability and general liability policies typically […]

Employment Law / Risk Management Resource Added

Staying Up To Speed With Employment Law Benjamin Aberant, of McCarthy Tetrault LLP, aptly points out in his recent article, Ontario Human Rights Commission releases new policy on gender identity and gender expression that employment law is a “complicated and constantly evolving area of law”. To help organizations stay informed, develop and or evolve, appropriate HR […]

Casualty Insurance Explained

Casualty Insurance def: Casualty insurance is primarily concerned with the losses caused by injuries to persons and legal liability imposed on the insured for such injury or for damage to property of others. Under common law, which applies in all provinces in Canada except Quebec(where they operate under Civil Law) has established that business owners owe […]

Blanket Contractual Liability Insurance Explained

Blanket Contractual Liability Insurance Defined Blanket Contractual Liability Insurance def: Coverage applying to all liability assumed by the insured in contracts, whether reported to the insurer or not. Note that the term “blanket contractual liability insurance” does not address the extent of the transferred liability the policy covers, only that it is not necessary to […]

IT Consulting Risk Management: A Must Read

IT Consulting Risk Management There is a great article by Duncan Card, of Bennett Jones, entitled: IT Consulting Contract’s Distinction With A Difference that is both highly informative and practical. The article includes excellent tips for managing risks associated with entering into “IT Consulting” contracts from the perspective of the contractor or consultant and the organization contracting the services. This article is a must read for […]

Absolute Exclusions: Is The ALIGNED Insurance Term Of The Day

Absolute Exclusions Explained Absolute Exclusions def: Exclusions found within certain insurance policy forms, precluding coverage for claims that are remotely—but not directly—related to the actual nature of the exclusion. The effect of such language is to defeat coverage in situations where it could be reasonably expected that coverage would apply. For example, an absolute exclusion […]

Blackout Insurance: Is A Blackout Covered By My Business Insurance?

Blackout Insurance Explained Whether it was in 2003, during the ice storm of 2013 or the most recent blackout on April 15, 2014, in the GTA businesses across Canada are asking a common question like “Does my insurance companies cover me for a blackout?” and is blackout insurance available? The short answer is that it […]

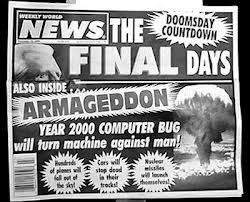

Y2K Exclusion: Is The ALIGNED Insurance Term Of The Day

Y2K Exclusion Explained What Is An Exclusion? A provision of an insurance policy or bond refers to hazards, perils, circumstances, or property not covered by the policy. Exclusions are usually contained in the coverage form or causes of loss form used to construct the insurance policy. What is a Y2K Exclusion? The year 2000/Y2K exclusion […]

Waiver of subrogation

Insurance insights 101 | What does a waiver of subrogation mean? Clarity matters. That’s why we write about key insurance terms and share insights about what specific terminology actually means. Every wonder what a waiver of subrogation actually is? Well, it’s an agreement between two parties in which one party agrees to waive subrogation rights against […]

Directors and Officers Disclosure Risk

Directors and Officers Disclosure A recent article by Anthony Alexander of McCarthy Tetrault LLP serves as a good reminder to all directors and officers of publicly traded companies about the importance of directors and officers disclosure being continuous, timely and accurate. About Directors and Officers Insurance Directors and officers (D&O) insurance is a type of liability insurance covering directors […]