As a tanning salon owner, you know the risks involved in operating your business. You also understand the importance of protecting your business and its assets against these operational risks. Not only could issues arise with your clients, but your tanning salon could suffer from unexpected weather-related damages, fire and/or financial loss due to litigation. Regardless of whether your tanning salon is an independent business or part of a large chain of companies, the financial damages could leave your shop permanently closed.

With tanning salon insurance from ALIGNED, you keep your business protected against litigation and covered perils. We offer comprehensive insurance policies tailored to your business needs, preferences and budget.

Why is Tanning Salon Insurance Important?

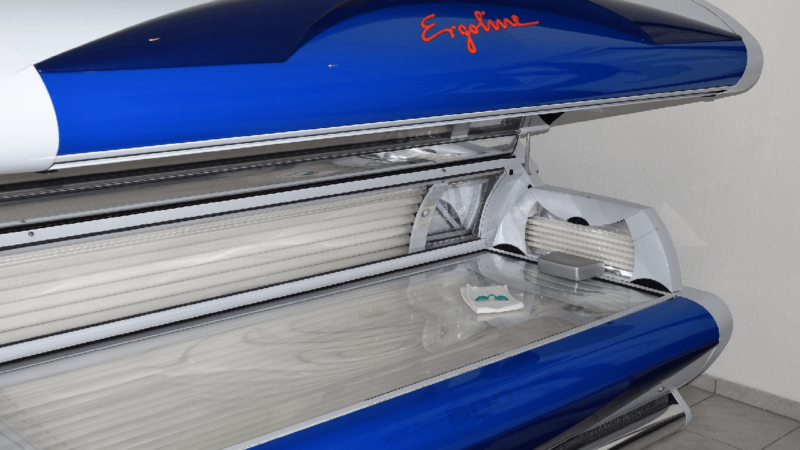

Any health, beauty, and wellness store should have insurance to protect themselves against the risks of selling services and products to the public. Especially with ongoing research about extensive UV rays exposure, businesses in the tanning industry need to be especially careful. Some risks your business face include:

- A customer suffers a slip-and-fall injury inside your salon.

- A customer suffers an injury or becomes ill after being exposed to your tanning beds.

- A customer suffers an injury or becomes ill after using a product you sold.

- A fire damages a part of your tanning salon.

- An employee steals from the cash register.

Even one lawsuit or unexpected event could leave your salon in financial despair. Tanning salon insurance protects your business by covering the medical, legal defence, and settlement expenses up to a certain limit, so you don’t have to pay out-of-pocket.

What Does Tanning Salon Insurance Include?

Commercial General Liability Insurance – also called CGL insurance, commercial general liability insurance provides coverage for injuries, bodily harm, and property damages occurring to a third party during your tanning salon operations. For example, you can be covered for legal costs, payouts, and medical expenses if a customer is injured at your salon.

Product Liability Coverage – product liability insurance protects your business against liability and damages resulting from the products you sell at your tanning salon. For example, insurance can covers medical expenses, settlement, awards, judgements against you etc.

Commercial Property Insurance – commercial property insurance protects your business against losses from fires, lightning, floods, windstorms, etc. It covers property like your tanning salon building, its contents, equipment, account receivable records, and inventory.

Employee Theft Insurance – theft is a concern for any business. Employee theft insurance covers any losses caused by employees stealing money and property from the business or the property of guests.

Find the Right Tanning Salon Insurance with ALIGNED

ALIGNED works with Canada’s top insurance companies to provide custom insurance packages at affordable prices. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.

Related Posts:

- Protecting Your Business with Beauty Salon Insurance

- Insuring Beauty and Tattoo Parlours

- What You Should Know About Microblading Salon Insurance

- How Cosmetic Company Insurance Can Protect Your Business