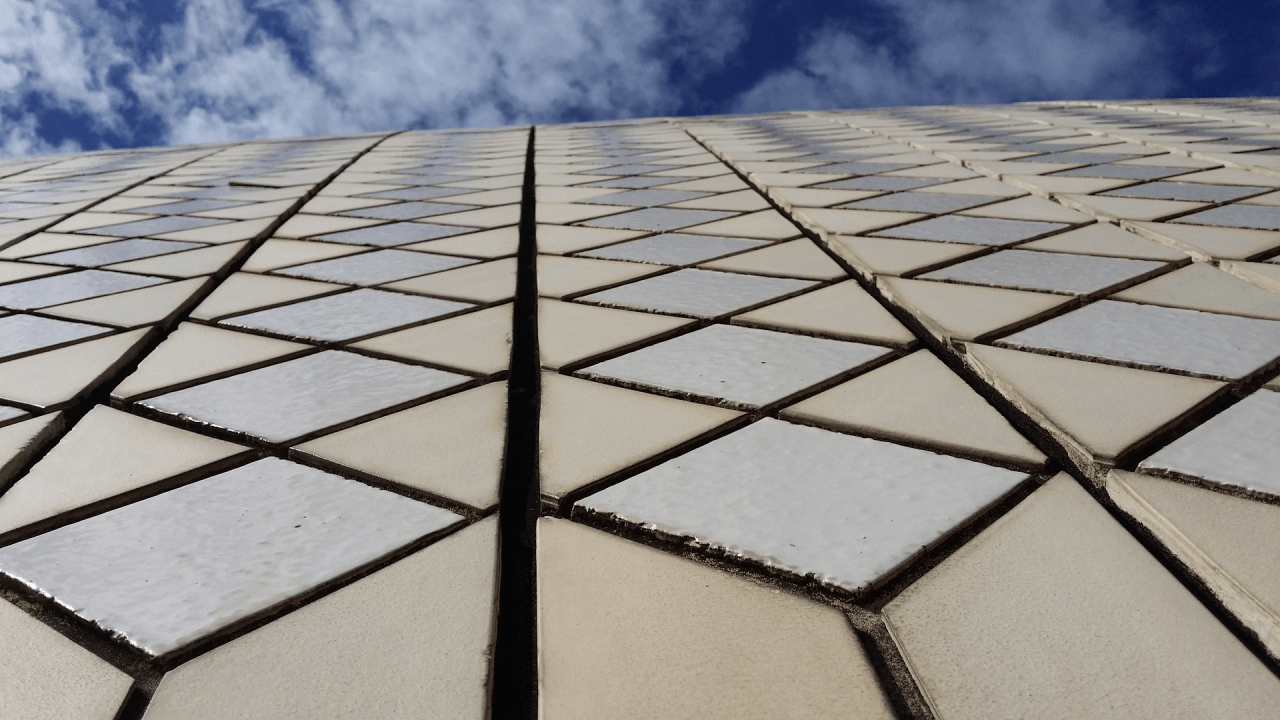

Interlocking Contractor Business Insurance

You take pride in the work your landscaping, paving and interlocking business does. You’re honest with your clients, use quality people and materials and ensure that you do clean work that lasts for years.

You also know that being insured not only protects your interlocking contracactor business and your clients in case of property damage or personal injuries, but that insurance also helps solidify your reputation as a reliable interlocking contractor.

Interlocking Business Insurance Coverages

There are a lot of risks that come with clearing, leveling and cutting stone for interlocking driveways, walkways, retaining walls and patios. Each of our interlocking business insurance plans is tailored to your company’s exact business needs. Insurance packages for interlocking businesses usually include:

Commercial General Liability Insurance – Commercial general liability insurance can cover your interlocking business for the costs resulting from injuries to third parties for bodily injury and property damage that your company would otherwise be liable for.

Commercial general liability insurance can also cover your interlocking business for lawyer’s fees, defence costs, settlements and judgements against you for lawsuits alleging personal injuries, property damage, false advertising, libel and slander.

Example 1: A client’s child trips while playing in the front yard around a stack of bricks and suffers a serious head injury. The parents decide to sue.

Example 2: Your Bobcat driver accidentally hits the side of a client’s house, causing major structural damage to the home.

A CGL policy could cover the healthcare, repair, replacement costs and legal expenses for any covered and ensuing lawsuits.

Property Insurance – Whether you lease or own your shop and office or own a home-based interlocking business, we can customize your coverage to protect your building, supplies, equipment, computers, tools and other business assets from perils like fires, flooding or theft. We can also provide coverage for tools that are lost, stolen or damaged on the jobsite and while in transit.

Commercial Auto Insurance / Commercial Vehicle Insurance – we can provide individual and fleet coverage for your trucks, vans and any other vehicles owned by your interlocking business that require insurance coverage.

If ever needed, we also provide construction bonds for contractors to bid on public and commercial contracts. For more information, visit our Types Of Commercial Surety Bonds In Canada page.

Get ALIGNED with insurance for interlocking businesses packaged by specialists in commercial insurance.

Insuring businesses is all we do. With ALIGNED, you get a commercial insurance specialist and advocate working as Canada’s top insurance companies to get your interlocking business the insurance coverage it needs at the best possible rates.

Contact an ALIGNED advocate to get a free quote on interlocking business insurance in minutes or get started right away by using our free online tool.