Are your overseas shipments well covered? What to know now…

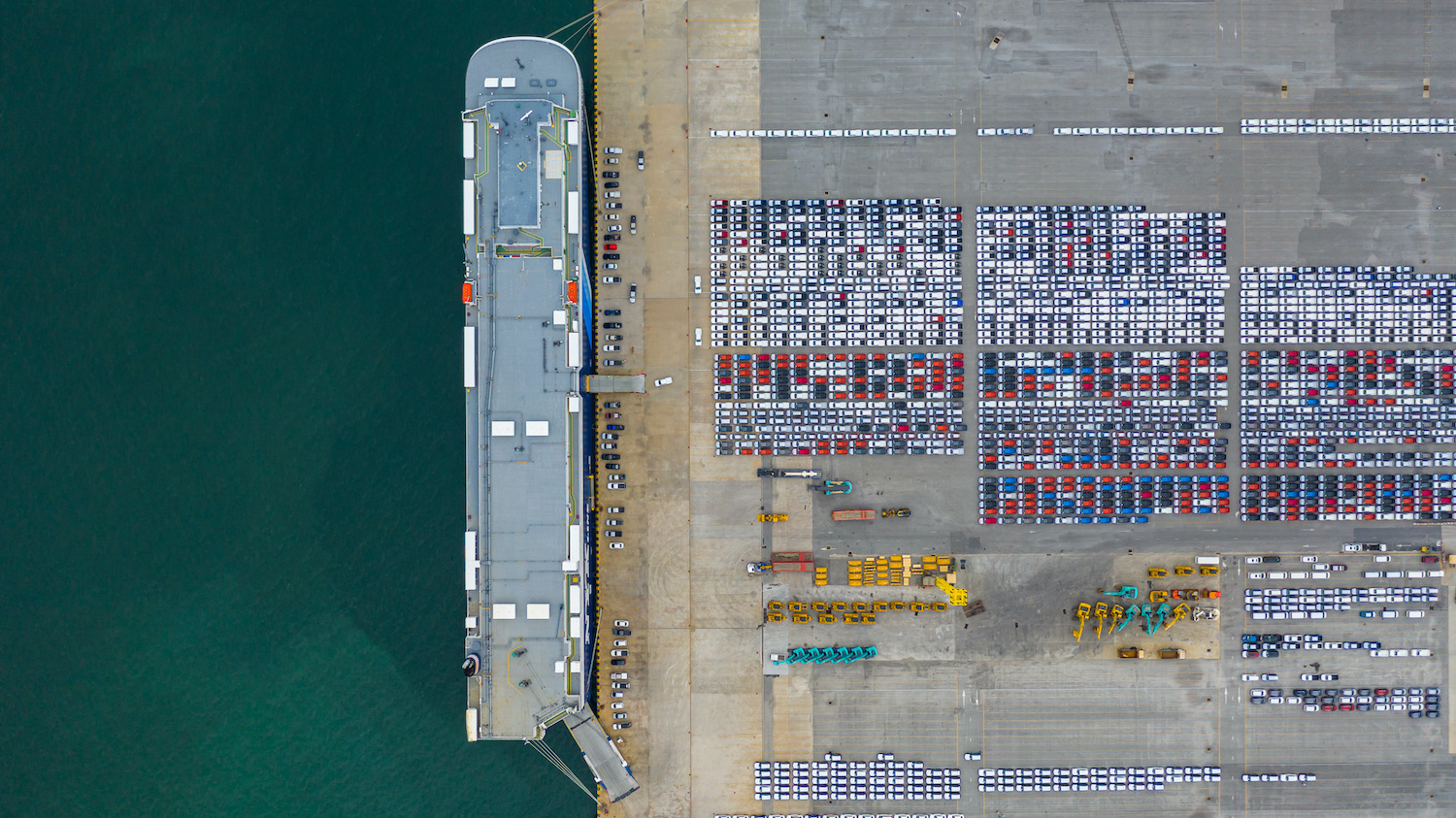

Global supply chain management. If you ship goods overseas, you are part of the global economy. And if you have concerns about getting coverage for your goods and products, you’ve landed on the right page.

Transporting goods across bodies of water has never been easy. In fact, marine insurance is the foundation of modern insurance.

According to Wikipedia, “marine insurance was the earliest well-developed kind of insurance, with origins in the Greek and Roman marine loan. It was the oldest risk hedging instruments our ancestors used to mitigate risk in medieval times were sea/marine (Mutuum) loans, commenda contract, and bill of exchanges.”1

Long before Marco Polo, Christopher Columbus, Vasco da Gama, John Cabot, Amerigo Vespucci and others made history and started global supply chains, Greeks and Romans knew what was at risk. In fact, one of the most controversial series of overseas shipments in history – the Elgin Marbles aka the Parthenon Sculptures – continues to be debated to this very day.

Related Matters: Here’s how to control risk with ocean cargo and sea freight insurance

Shipping products overseas has never been and will never be easy. This is why it is so important to work with an insurance brokerage that has deep relationships with top Canadian insurance companies. And a team of insurance brokers who work exclusively with commercial insurance products.

We are that team. And ALIGNED brokers are those brokers. We focus 100% on business insurance only and work with more than 65 of Canada’s top property and casualty insurance companies.

When it comes to aligning the best products and solutions for your Vancouver business, we are here to help. An ALIGNED Insurance broker Vancouver can deliver the support and options you need to ensure your overseas shipments are well covered.

COVID-19 and what’s changing for cargo insurance during the pandemic

Businesses are struggling to stay afloat during COVID-19. Therefore, many are pivoting. Insurance companies are also businesses and are also facing challenges during the pandemic. This is because when things change, so do material risks.

A recent Canadian Underwriter article highlights some of what is and may be changing in the area of marine cargo insurance.

For instance:

- “Marine cargo policies that were drafted before the COVID-19 pandemic may need a second look because of the way business disruptions and lockdowns are affecting the global supply chain.”2

- “Some lockdowns are affecting ports overseas. As a result, some ports are not able to receive cargo at the same rate as they could before the pandemic. …This is an issue for marine cargo clients because delay is often not a covered peril.”3

- “There is an additional cost to re-routing goods and some of these are due to government prohibitions – or to governments putting in new measures due to the pandemic. Often these additional costs are not covered under insurance policies.”4

With government mandated lockdowns and closures changing from week to week, there is still much that’s unknown. However, what’s not changing is the need for shipments going overseas to be well insured.

If you are looking for a Vancouver insurance broker who can help you find the best options for your marine cargo coverage, look no more.

ALIGNED Insurance brokers know how to find solutions even during challenging times. We can deliver the options and value you need to stay afloat while charting a course for a more positive future.

8 cargo risks exposed | What to know when you are buying insurance

Multiple risks. Just like any other form of commercial insurance, there are varied and complex exposures related to shipments going overseas. Above all, these risks need to get covered. For instance:

- Cargo Legal Liability — Covers various logistics services providers for operations liability. For example: freight forwarders, customs brokers, warehouse staff, truckers, aircraft operators, etc.

- Exhibition Risks — Often a customer sends their goods to a show to promote their product. Transportation to, from and during the show can all be covered.

- Physical Loss or Damage to Cargo — Domestic and worldwide coverage for most types of cargo. For example: general cargo, stock throughput, project cargo, manufactured goods, commodities, heavy-lift, valuable cargo, hazardous cargo and perishable cargo.

- Political Risk — Refers to the negative consequences that result from the action or inaction of government, and provides coverage for assets in foreign countries, contract frustration and political violence.

- Professional Liability — Coverage for the professional liability of a load broker, freight forwarder, or customs broker.

- Rejection Insurance – Covers the risk of rejection of the cargo by a governmental authority.

- Stockthroughput Risks – Coverage for goods while in storage, which is useful for a company that imports, stores, and then distributes their cargo.

- Supply Chain / Trade Disruption — Covers Net Profit or Extra Expenses due to non-arrival or delayed arrival of goods due to a disruption in transit. Can also cover loss of revenues due to delay in start-up (DSU) of cargo and ship building projects.

Related Matters: Some of the most common commercial cargo insurance coverage mistakes might surprise you

In addition to these coverages there are also some specific things that you should know when you are buying cargo insurance.

Such as:

- You can protect your cash flow. Your interest can be insured while you are financially at risk.

- The carrier’s contract of carriage restrictions will not limit the coverage you can get.

- Full value – including any profits if necessary – can be covered.

- Coverage is placed on the right conditions, with terms that you have negotiated.

- When a claim happens, you can depend on prompt and efficient local and professional claims service and support.

We know how to get you the coverage you need when you face multiple risk exposures. A Vancouver ALIGNED Insurance broker can deliver coverage solutions for all your shipments going overseas.

Contact us now to get your insurance properly…ALIGNED.

In short | If the Port of Vancouver is where you ship from, we can help!

Solutions for marine cargo risks. When your goods go overseas, you are taking on expansive risk exposures. You need to know that the coverage you choose for your goods and products will specifically cover those risks.

Talk to an ALIGNED insurance broker now. Get your cargo risks covered

Source(s): 1 Wikipedia.org: Marine insurance ; 2,3,4 CanadianUnderwriter.ca: How COVID-19 is changing marine cargo insurance ;