Audiologist Business Insurance

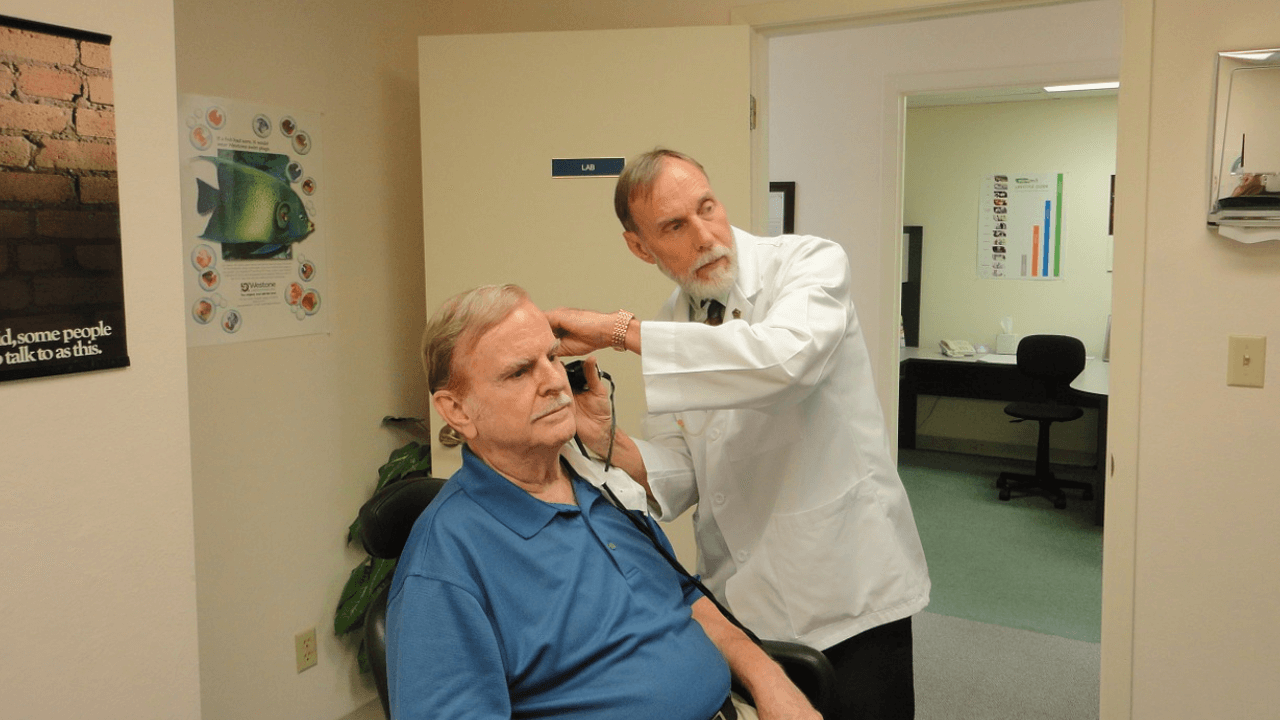

As an audiologist, your primary job is identifying, diagnosing, and treating disorders within the auditory system. While this might not sound like anything especially risky, medical malpractice suits are extremely common, and without insurance, a major lawsuit could result in the shuttering of your practice.

Plus, in this line of business, the majority of patients are elderly, which puts you even more at risk. As a result, many provincial colleges in Canada require audiologists to have insurance as a way of protecting themselves.

ALIGNED is pleased to offer comprehensive audiologist business insurance that covers a wide range of liability risks, such as lawsuits stemming from misdiagnoses, conflicting treatments or diagnoses from other practitioners, injuries during treatment, or damage to testing equipment. Protect yourself today by investing in a quality audiologist business insurance policy that will help you cover court and lawyer costs, along with other legal fees, in the event something goes wrong.

ALIGNED brokers will work with you every step of the way in curating your customized audiologist business insurance policy. ALIGNED prides itself on offering affordable insurance to all. The cost of your unique audiologist insurance plan will depend on the number of employees and patients your business has, as well as the amount of profit you earn each year.

Protect Your Business from These Liabilities with Audiologist Business Insurance

Our far-reaching audiologist business insurance policies aim to provide as much protection as possible. Primarily, they serve to offer financial protection if an audiologist causes damages, losses, or injury to a patient as a result of their errors or mistakes.

As all medical professionals know, several problems can arise over the course of a day. That is where audiologist business insurance comes in. ALIGNED offers protection against the following exposures or risks:

- Misdiagnosis of a patient leading to a health issue becoming more severe

- Offering bad advice to a patient

- An injury resulting from treatment (such as a patient tripping over a wire in your treatment room or slipping on a wet floor and hitting their head)

- Physical damage to a treatment room or testing equipment

- Conflicting diagnoses and treatments between yourself and other practitioners

What Can Hearing Aid Services, Audiologists Liability Insurance Do For You?

Hearing Aid Services and Audiologist Liability Insurance is here to provide peace of mind to you as you go about your daily work life identifying, diagnosing and treating auditory disorders in your patients. We know that your patients are often elderly, and that this adds a level of complexity to your job. In this multifaceted profession, having the right insurance means you are covered in the event that something goes wrong.

Audiologist Liability Insurance can help protect you when dealing with the inherent risks of your business. The right policy will cover any court costs associated with lawsuits brought by patients in the event of any of the following: misdiagnosis, conflicting diagnosis or treatment with another audiologist, any injury that might occur to your patients during treatment, as well as damage to your equipment.

Hearing Aid and Audiologist Insurance helps you by allowing you to concentrate on your patients and provides coverage for any of the unforeseen circumstances that might arise during treatment.

How Much Hearing Air Services, Audiologist Insurance Coverage Do You Need?

The type and extent of Hearing Air Services and Audiologist Insurance coverage you need will depend on several factors. As an audiologist or hearing air service specialist, you have trained for many years to provide your services. This critical work of auditory testing and diagnosing issues and conditions within the auditory system carries with it a risk factor that you must protect yourself against.

Your coverage should be as broad-reaching as possible and should include protection against any errors or mistakes that occur during the course of patient treatment.

ALIGNED’s audiologist business insurance policies provide extensive financial coverage against losses, damages and injury to patients as a result of the audiologist professional’s misdiagnosis or other errors. The extent of the coverage each individual practitioner requires will depend on the specific nature of her or his business. Your ALIGNED broker will consider a number of factors when recommending coverage and will draw on their extensive knowledge and network of insurance brokers.

How Much Does Hearing Aid Services, Audiologist Liability Insurance Cost?

The cost of receiving protection against claims against you as a Hearing Aid Service and Audiologist depends on a few different factors. Most importantly, the number of employees you have and the number of patients you see in your business contribute to the level of coverage you require. Your ALIGNED broker will also consider your level of training and your annual income to come up with the right coverage package for you. Whether you practise independently or within a group of practitioners could also help determine your policy cost.

At ALIGNED Insurance, we pride ourselves in delivering affordable insurance coverage to all. We know that having adequate professional Audiologist Insurance coverage is normally required by your provincial college in order for you to serve your patients. We are here to help you in providing your important service by devising the best insurance package for you.

Find the Right Audiologist Business Insurance from ALIGNED

As one of the leading insurance brokerages in Canada, we offer an extensive range of insurance policies, including audiologist business insurance. Our experienced team of insurance brokers will work with you to craft a customized policy suited to your specific audiologist business.

Tailor-made coverage, affordable rates, and top-notch customer service are what you get with ALIGNED. Click Here To Get A Quote or contact one of our business insurance experts for information or with any questions you may have.