Motion Picture Insurance

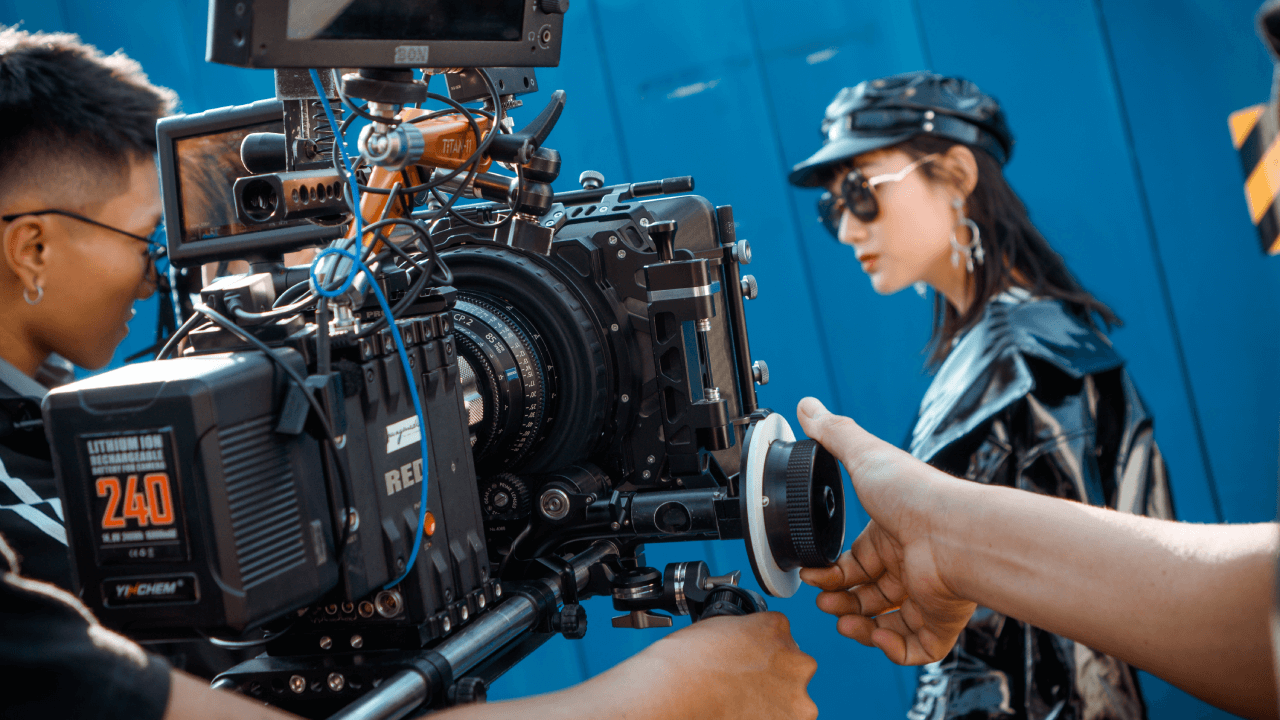

For film and television production companies that produce motion pictures, documentaries, industrial, commercial and educational content, the art of storytelling involves its own real-world conflicts that can lead to injuries, losses, and liability.

Our customizable motion picture insurance packages help you mitigate those risks, keep your cameras rolling and reach a satisfying denouement for your production.

How Motion Picture Insurance Can Protect Your Production Company

The main coverage included in our motion picture insurance packages is Media Liability Insurance which is designed for film & television production companies to address the legal liability risks they face.

Acts covered by our Media Liability policies include but are not limited to:

- Copyright & trademark infringement (coverage also includes defense of your own intellectual property)

- Libel, slander & defamation

- Unauthorized use of name, likeness, and invasion of privacy

- Breach of confidentiality

- Errors and omissions, negligence

- Breach of contract

- False advertising

- Deceptive trade practices

- Trespassing

- Harassment, emotional distress, unlawful detention

Other Motion Picture Insurance Coverages

The following coverages are typically included in our motion picture insurance packages:

Commercial General Liability (CGL) Insurance – protects your production company against claims of personal injury, property damage, false advertising, libel/slander, and more. Optional coverage can include contents coverage and improvements/renovations made to leased properties.

Commercial Property Insurance – to protect your cameras, wardrobe, props, sets, sound & lighting equipment, office contents, etc., from perils such as fires, flooding, sewage backups, earthquakes, water damage, windstorms, theft, vandalism, and more. Coverage includes extra expenses incurred for damage caused by a covered peril to a filming location.

Non-owned Auto Liability Insurance – provides coverage for the crew that drives personal vehicles for production purposes as well as rental vehicles used during motion picture productions.

Umbrella Liability Insurance – Umbrella liability insurance provides coverage in case the costs of a claim go over any of the above underlying policy limits.

Highlights of ALIGNED’s Motion Picture Insurance Packages

These are some of the benefits and protections your production company can enjoy with our motion picture insurance packages include:

- Cast insurance can include additional expenses to complete principal photography if death, injury, or illness afflicts an insured cast member.

- Specialized expertise and 24/7 claims services.

- Coverage for medical expenses and property damage costs for a covered claim.

- Coverage for lawyer’s fees, defense costs, settlements, and awards for damages for covered claims.

Get ALIGNED with Motion Picture Insurance from a Company that Understands that the Show Must Go On.

Commercial insurance is all we do. ALIGNED advocates save you time, money, and the hassle of shopping around for the right insurance at the best rates to protect your motion picture and film & television production company.

Contact an ALIGNED advocate to get a free quote on motion picture insurance in minutes or get started right away by using our free online tool.