Do you need insurance for your Industrial Design Company?

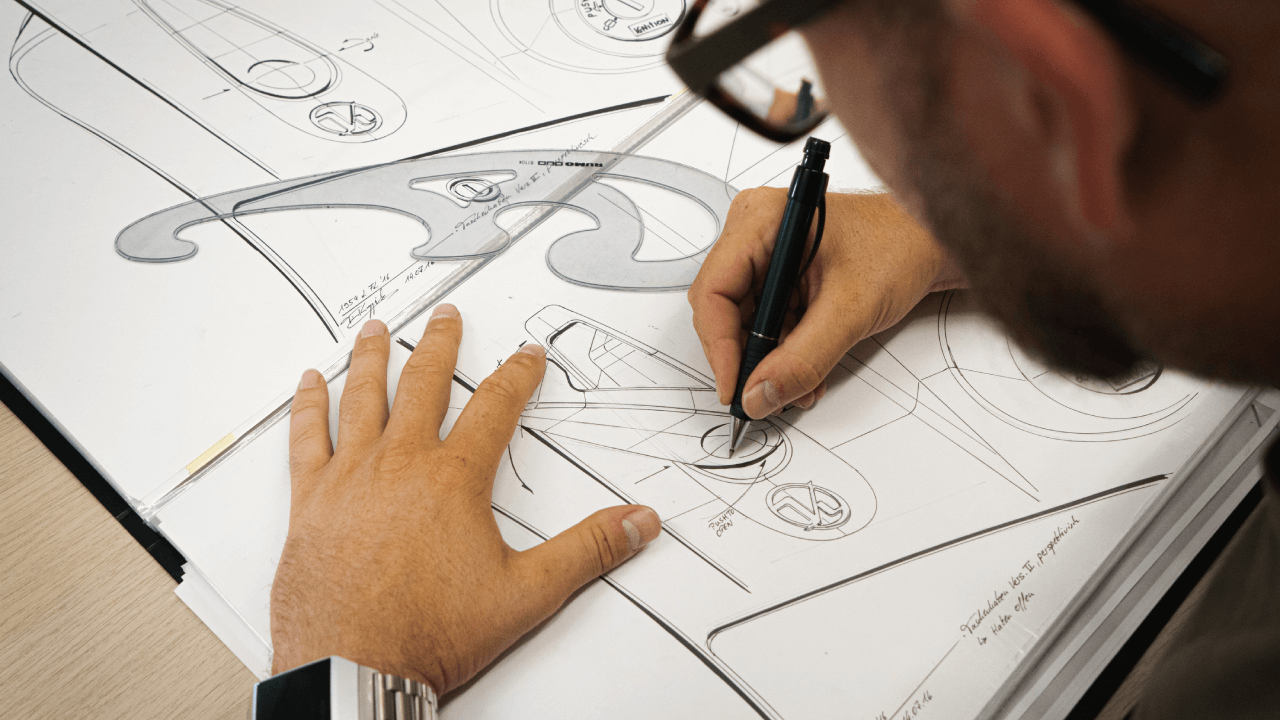

Yes, yes you do! As an Industrial Design Company owner, you are combining various skills to make everyday products for a variety of clients. Your clients may range from manufacturers to sports companies to hospitals. Catering to the needs of such diverse industries combines the skills and talents of both engineering and art. Your business makes products for a variety of fields, such as the automobile industry, medical equipment, furniture, recreational equipment and many more. Your team can be involved at each stage of the design process – from concept design to mechanical design, prototyping and manufacturing design.

These products are important to everyone and involve innovation as well as problem solving. Your industry is crucial to society, and your responsibilities include protecting your business with the right insurance to guard against unforeseen circumstances.

What is the best insurance for Industrial Design Companies?