Elder Care Insurance

Elder Care Insurance: Protecting Your Senior Care Business In the elder care industry, the stakes have never been higher. Senior care providers today face more frequent and costly lawsuits than ever before – in fact, one recent industry analysis found that claims exceeding $1 million have more than doubled in frequency over the past decade. […]

Life Insurance for Business Owners

Life Insurance for Business Owners: A Strategic Tool to Protect Your Business and Family As a business owner – whether you’re a CEO, founder, president, or entrepreneur – one of the smartest moves you can make is incorporating life insurance into your business planning and budgeting. Life insurance isn’t just a personal safety net; it’s […]

Business Fraud Insurance

Business Fraud Insurance: Combating the Growing Threat of Fraud with Prevention and Protection The Rising Threat of Business Fraud: Business fraud has emerged as a fast-growing, increasingly sophisticated threat to companies of all sizes. Experts warn that fraud is now among the “most prevalent problems” facing businesses. From rogue employees embezzling funds to cybercriminals tricking […]

Calgary Insurance Brokers

Calgary Insurance Brokers: Expert Insurance Solutions for Local Businesses At the foothills of the Rockies, Calgary’s businesses face a risk landscape as dynamic as the city itself. From oil & gas ventures grappling with market swings to tech startups guarding against cyber threats – and from construction firms braving extreme weather to logistics fleets navigating […]

Political Risk Insurance

Political Risk Insurance: A Shield for Canadian Companies in Global Markets In an age of geopolitical uncertainty, political risk insurance has become an essential safeguard for Canadian companies doing business internationally. This specialized coverage protects against financial losses caused by unpredictable government actions and political turmoil abroad. From a sudden expropriation of assets by a […]

What Is A Certificate of Insurance (COI)?

What Is A Certificate of Insurance (COI)? A Certificate of Insurance (COI) is a brief but important document that provides proof of an active insurance policy. In other words, it’s a snapshot of your business’s insurance coverage, summarizing key details like which policy you have, the coverage limits, and the policy’s effective dates. If you’re […]

Kitchener-Waterloo Insurance Brokers

Kitchener-Waterloo Insurance Brokers: Tailored Protection for Local Businesses Kitchener-Waterloo (KW) is more than Canada’s “Silicon Valley North” – it’s a dynamic region where tech startups, manufacturing powerhouses, and construction firms thrive side by side. Such a diverse business ecosystem has unique insurance and bonding needs. In this post, we’ll explore why KW businesses need specialized […]

Should I Pay My Business Insurance Monthly or All Up Front?

Should I Pay My Business Insurance Monthly or All Up Front? Paying for business insurance monthly (through a premium financing plan) offers greater cash-flow flexibility, while paying up front (annually in one lump sum) can save you financing costs. In practice, many businesses find that the benefits of monthly payments – smoother budgeting, preserved capital, […]

Data Centre Insurance

Data Centre Insurance: Protecting the Backbone of the AI Era In a world increasingly fueled by artificial intelligence (AI) and cloud computing, the “data centre” has emerged as critical infrastructure—a backbone supporting everything from financial transactions to hyper-realistic AI chatbots. Whether a data centre is an enterprise-owned facility or a multi-tenant colocation hub, failures are […]

Why Don’t More Companies Buy Cyber Insurance?

Why Don’t More Companies Buy Cyber Insurance? Cyber attacks are surging, yet many businesses remain uninsured against this threat. In fact, companies lose billions of dollars to cybercrime each year and the average cost of a full data breach in Canada is about C$1.32 million. Despite these stakes, fewer than one in ten Canadian businesses […]

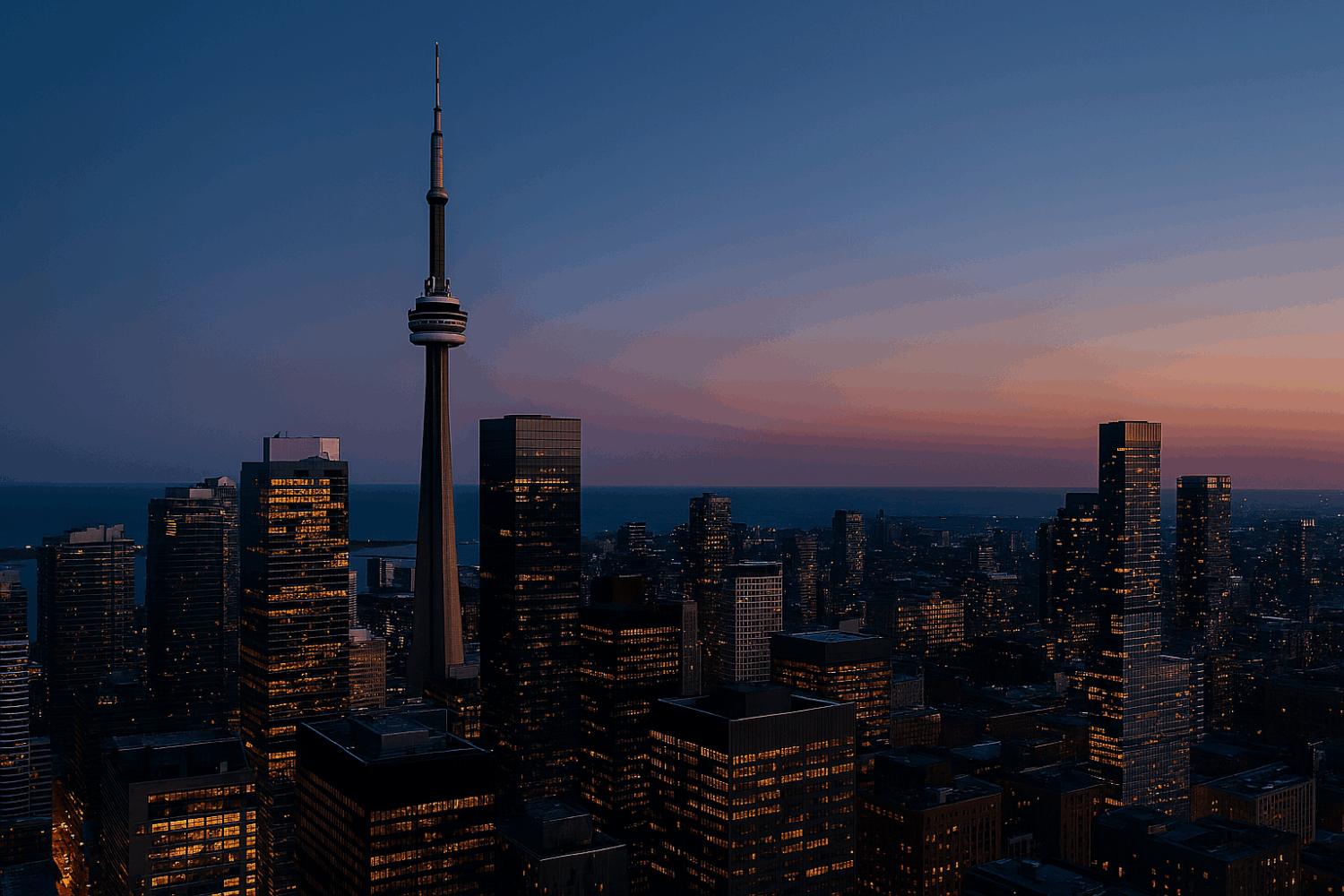

Toronto Insurance Brokers

Toronto Insurance Brokers: Specialized Insurance Solutions for GTA Businesses Toronto’s business community is remarkably diverse and dynamic, encompassing everything from finance and tech to retail and hospitality. As Canada’s largest regional economy and business capital, the Toronto region contributes roughly 20% of the nation’s GDP and is a top ten global financial centre. With this […]

Animal Shelter Insurance

Animal Shelter Insurance: Covering All Your Shelter’s Risks As a board member, executive director, or controller of an animal shelter, your priority is caring for the animals. But what about protecting the organization that cares for them? This is where animal shelter insurance comes in. It provides a safety net for your shelter’s business needs, […]

How to Protect Your Business from Theft

How to Protect Your Business from Theft: Balancing Trust and Risk Management Security is essential to the stability and success of any business. Theft—whether perpetrated by outsiders or insiders—poses significant financial and operational risks to companies of all sizes. In fact, studies show that internal theft is a factor in roughly 33% of business bankruptcies. External […]

Boxing Gym Insurance

Boxing Gym Insurance 101: Protect Your Gym from a Financial Knockout Boxing gym insurance can provide the necessary coverage to protect your boxing gym from all kinds of risks, including property damage, third-party lawsuits, and more. Keep reading to learn more about how ALIGNED can help you find the right commercial insurance policy for your […]

Cambridge Insurance Brokers

Cambridge Insurance Brokers: Specialized Business Insurance Solutions for a Thriving Community Cambridge’s business community – spanning historic Galt, Preston, and Hespeler – is stronger than ever. From high-tech startups to manufacturers with century-old roots, local companies drive a vibrant economy. But thriving in Cambridge also means navigating unique insurance and bonding needs that off-the-shelf policies […]