Directors & Officers Insurance Debunked

Directors & Officers Insurance Debunked Directors and officers insurance is a fundamental component of any company’s risk management program. A lack of directors & officers insurance may dissuade talented individuals from seeking an executive position at your company, as they don’t want to put their personal assets at risk in the event of a lawsuit. Directors & […]

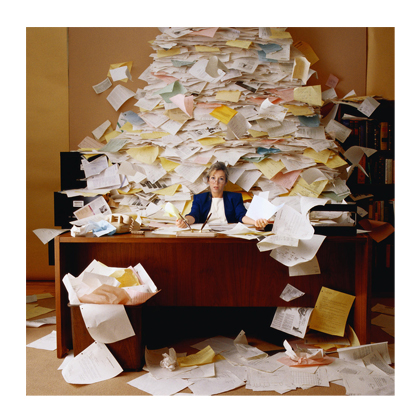

Corporate Record Keeping: Practical Risk Management

Corporate Record Keeping: Practical & Important Risk Management Corporate record keeping preserves a company’s history of business and financial decisions. Unfortunately, creating and maintaining accurate records is often overlooked by companies of all sizes. It’s more than just a corporate formality; corporate record keeping is a critical element of directors and officers liability risk management […]

Compliance: Facts, Questions & ALIGNED Solutions

Compliance Support For Your Organization. Compliance Notable Fact: Constantly changing federal and provincial legislation, from OH&S regulations, Canadian Anti Spam Legislation (CASL) to Transport Canada requirements make it difficult to keep up with regulatory compliance. Fines & penalties can be financially ruinous – in fact, fines can be extremely costly and failure to comply with regulations […]

Fidelity Insurance Explained

What is fidelity insurance? Having a need for fidelity insurance may sound outlandish at first, but the harsh reality is that nearly every business is eventually victimized by fraud or theft. In this day and age, thieves (including your employees) do not need direct access to cash to steal from you; merchandise, supplies, and securities […]

Kidnap and Ransom Insurance: An Introduction

Introduction to Kidnap and Ransom Insurance A kidnapping abroad is a terrifying concept. Assailants may leave you bound and gagged in a dark room or they might threaten you with torture to persuade negotiators to comply. What if you don’t have access to the kind of money they expected to get from you? What happens […]

Discontinued Operations Insurance Explained

Why do I need insurance after I close my business? From a risk management perspective, there are at least three reasons why business owners may wish to maintain their insurance even after the business is no longer operating: Insurance may be able to cover legal expenses and judgment costs in the event of a lawsuit […]

Workplace Safety: Facts, Questions & ALIGNED Solutions

Workplace Safety Workplace Safety Notable Fact: A comprehensive workplace safety program reduces injuries, WSIB costs and the potential for government fines & penalties. Workplace Safety Questions: Are you looking to improve your bottom line? Do you currently have a safety program? If so, how is your current insurance broker contributing to create, review or improve it? Are you hoping to […]

Insurance Industry Overview

Nature of the Insurance Industry The insurance industry provides protection against financial losses resulting from a variety of hazards. By purchasing insurance policies, individuals and businesses can receive reimbursement for medical expenses, loss of income due to disability or death and losses due to car accidents, theft of property and fire and storm damage etc. […]

Directors and Officers Liability Insurance Overview

Directors and Officers Liability Insurance Unlike a commercial general liability insurance (CGL) policy that provides coverage for claims arising from property damage and bodily injury, a Directors and Officers Liability Insurance policy specifically provides coverage for a “wrongful act” such as an actual or alleged error, omission, misleading statement, neglect or breach of duty. Q. Who […]

Additional Insured Explained

Additional Insured Explained When reviewing the insurance requirements section of a contract, lease, sales agreement etc., pay particular attention to the additional insured requirements. There are numerous reasons why companies request that they be added to your organization’s insurance policies as an additional insured via a certificate of insurance or a specific additional insured endorsement. […]

What is Inland Marine Insurance?

Inland Marine Coverage Inland marine coverage is property insurance for property in transit over land, certain types of moveable large or high-value property like manufacturing equipment, technology (servers, microprocessors, camera equipment etc.) instrumentalities of transportation (such as bridges, roads, and piers, instrumentalities of communication (such as television and radio towers) etc. Many inland marine coverage […]

Indemnity Agreement Info and Guide | ALIGNED Insurance

Indemnity Agreement: What is it and how can it help my business? Understanding your business’s risk exposures is the cornerstone to managing them. Whether your business relies on outside vendors to provide goods and services, or you’re a provider of goods and services to your clients, you should be aware of how to take contractual […]

Business Interruption Insurance Canada | Ordinary Payroll

Should you insure Ordinary Payroll? Learn about Business Interruption Insurance Canada… Insurance insights. We take pride in providing informative insights about business insurance Canada. Whether you want general information about the coverages insurance companies in Canada offer for businesses, or need something specific like baby product liability insurance Canada, we provide useful insights. With more […]

Slip Trip and Fall Prevention: Tips & Tricks

Slip Trip and Fall Prevention Operating a businesses can create a multitude of slip trip and fall hazards, whether it be from spilled liquids, high customer traffic or other means in office space, sidewalks, kitchens, manufacturing area, dining areas and/or storage rooms. Everyone can all play a part to prevent slip trip and fall hazards from causing […]

TIV (Total Insurance Value) Explained

What is TIV aka Total Insurable Value? Total insurable value aka TIV is a property insurance term referring to the sum of the full replacement cost value of the insured’s covered property, business income values, and any other insured property. TIV is typically used in property insurance policies for businesses and other organizations that insures against damage to an […]