Home » Why Work With Us?

It’s important to know who you are buying insurance from. This is why we are a fiercely independent brokerage that works with, not for, 70+ top Canadian insurers that are AM Best A- rated or better!

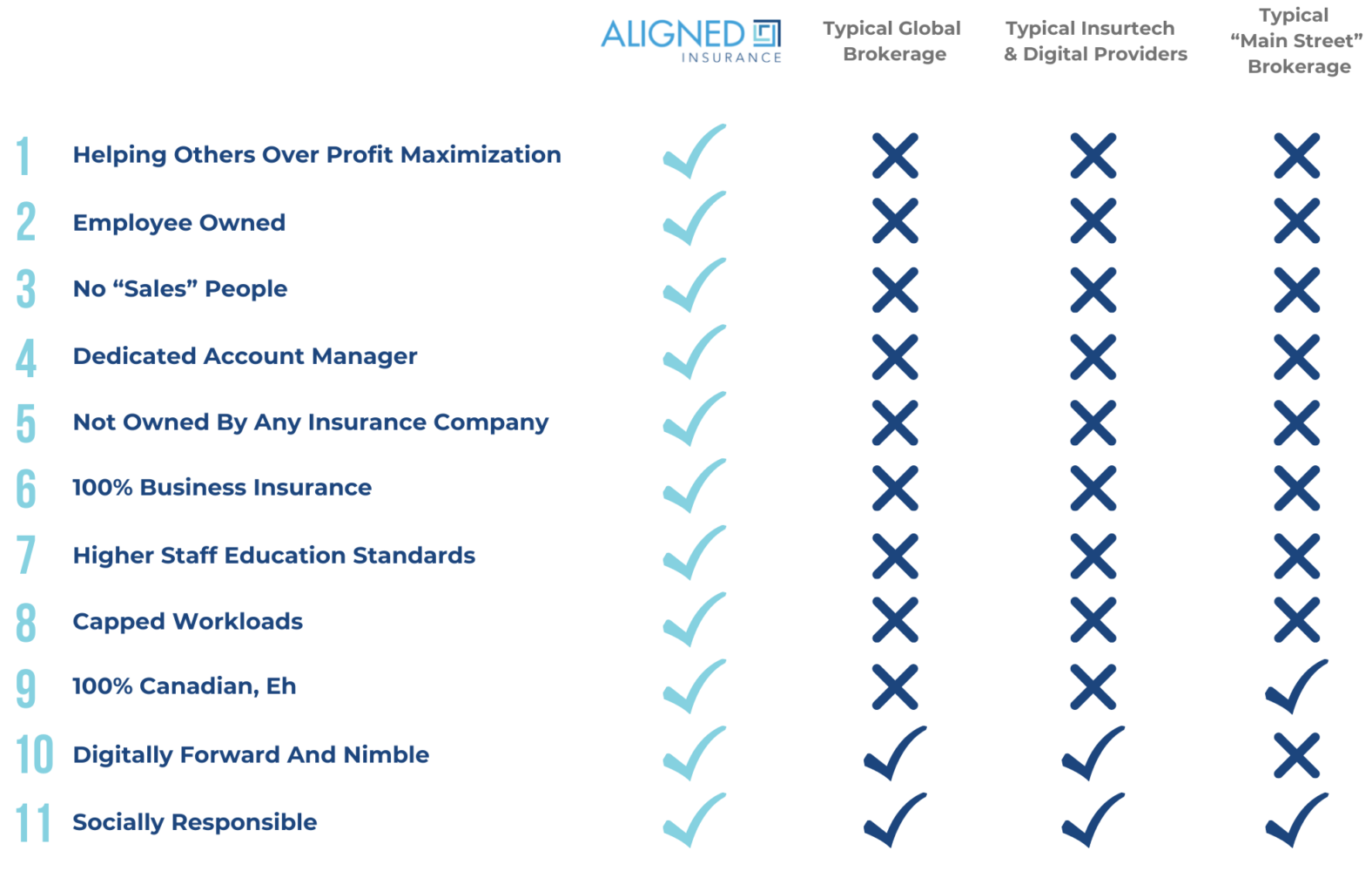

You can rest assured that we’ve always got your back. Unlike almost all of our competitors, we specialize in business insurance products and services. We focus solely on providing the best expertise, products and service experience possible to you and your business.

*Based on our experience and knowledge of the market

Every day, we help our clients handle uncertainty and threatening risks with expert advice and coverage. Our values align us in delivering a truly exceptional experience to YOU!

You want to talk to the same and right person every time. This is why your ALIGNED Advocate has their own toll-free 1-800 number. And when you have a quick query, need a certificate of insurance or are uncertain about who to contact, our Customer Experience Associates are happy to help!

We’ll don’t have “Sales” People at ALIGNED. No one likes “being sold” and that’s why the person you start working with as a prospect becomes your partner. Business insurance requires a thorough understanding of your operations, exposures, risks and more. Whether you are considering our services or renewing your coverage, we advocate for you!

We take pride in the fact that ALIGNED is 100% Canadian and employee-owned. Our roots date back to a 1912 Ontario insurance brokerage that now serves all of British Columbia, Alberta and Ontario through our offices in Vancouver, Calgary, Toronto and Cambridge. We’re also expanding our team to ensure we’re positioned to deliver consistent value to our growing number of clients across the country.

Accuracy, speed and quality advice are essential when you are buying or using your insurance. We know that your experience with us should never be rushed or just an online transaction. This is why your ALIGNED Advocate only supports a limited number of clients. Through capped workloads, we ensure you and your business always receive the service and responsiveness you expect and deserve.

Fast, Free, Easy & Quick Insurance Quotes

© 2024 Copyright ALIGNED Insurance Inc. All Rights Reserved.